The Wedding Planners & Event Managers among the tourism, hospitality and entertainment industries, have been allowed by the Central Board of Indirect Taxes and Customs (CBIC) to claim the refunds of goods and services tax (GST) paid on the advances, that the establishments had given/received for events or bookings which now stand cancelled.

Making headway towards providing the relief to the feelings of the brunt of business losses, the CBIC has made this move of allowing such refund. The move comes as an attempt to mitigate losses for the aforementioned industries due to the extended nationwide lock-down, now till May 3, owing to the spread of COVID-19 virus.

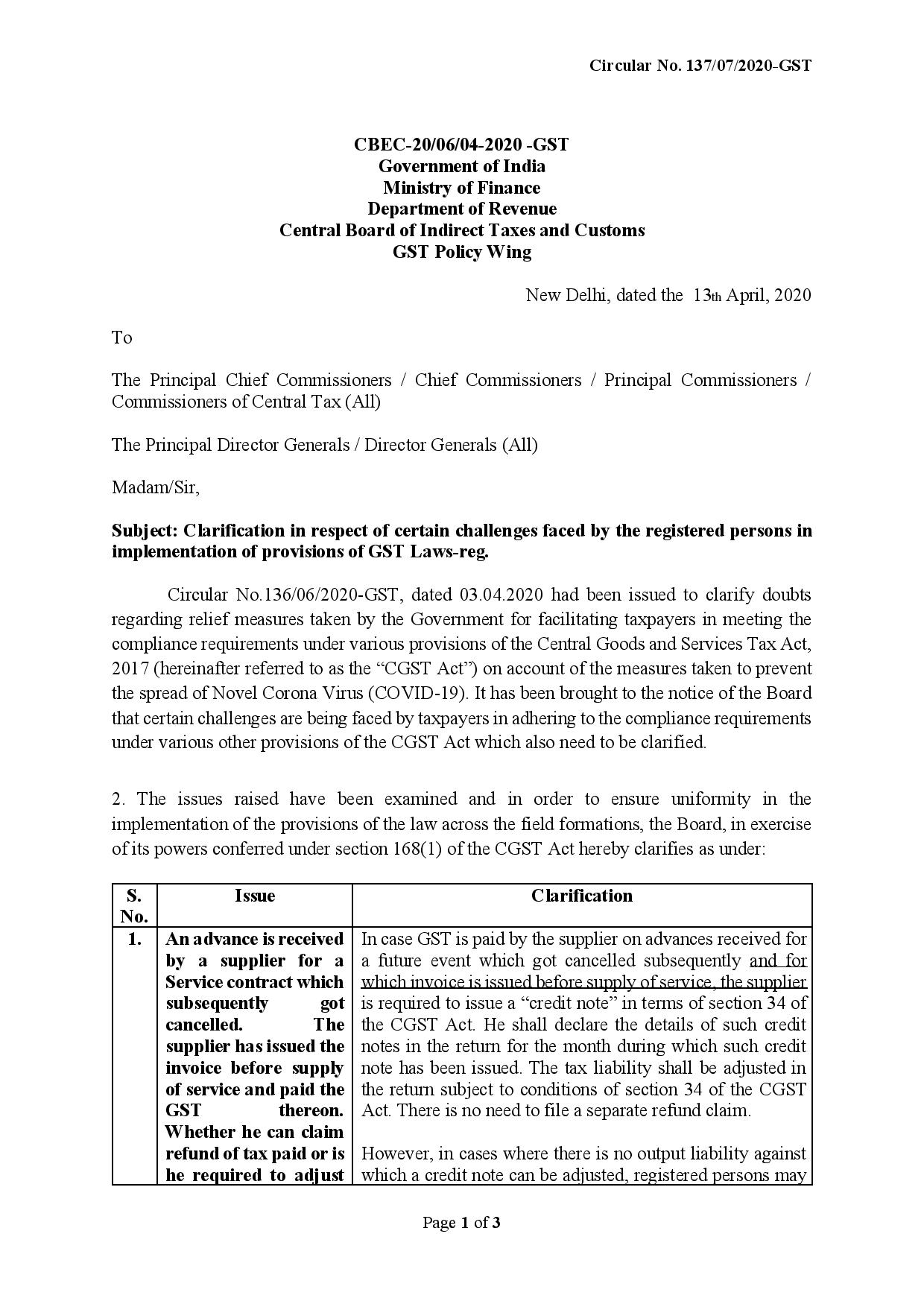

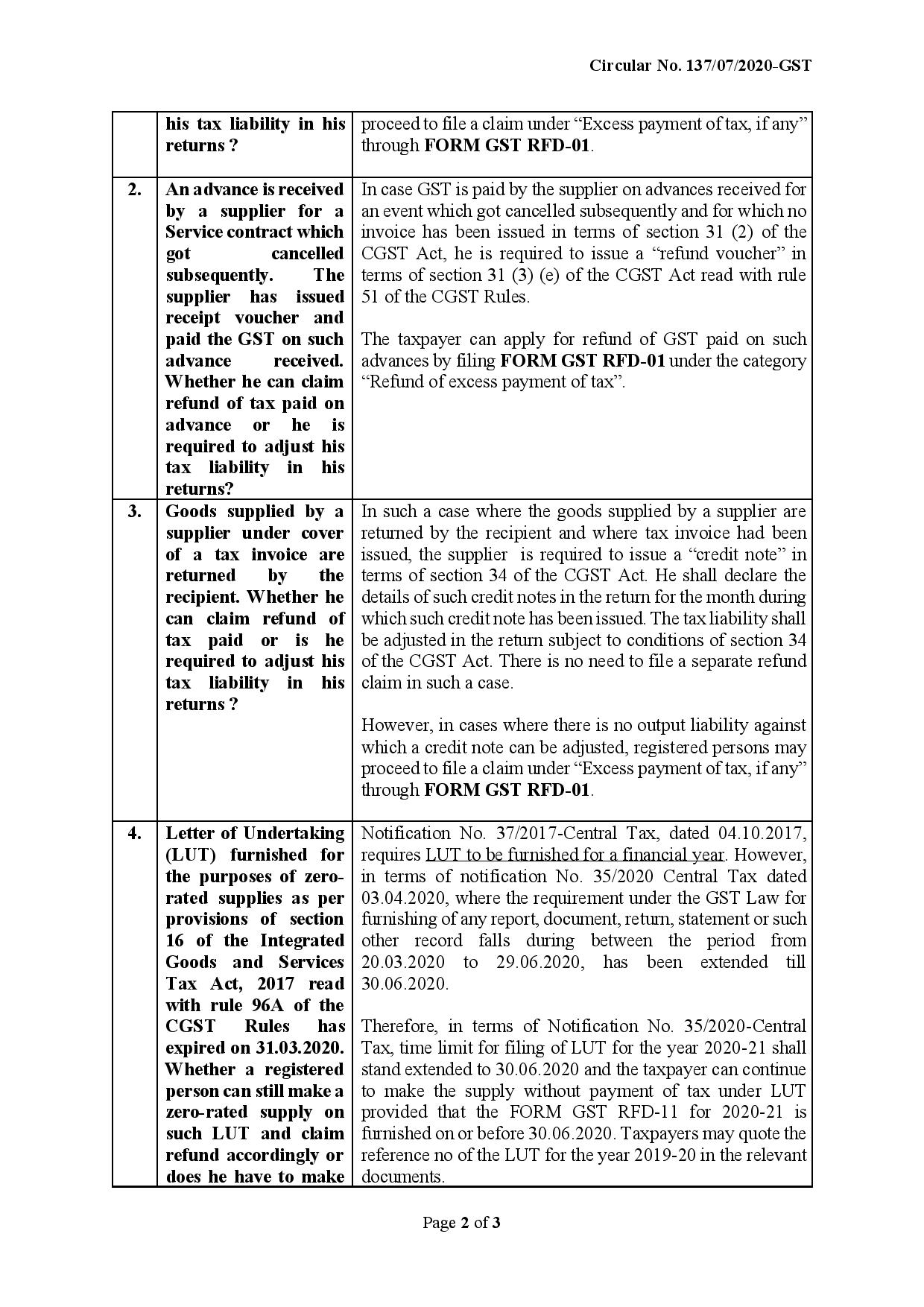

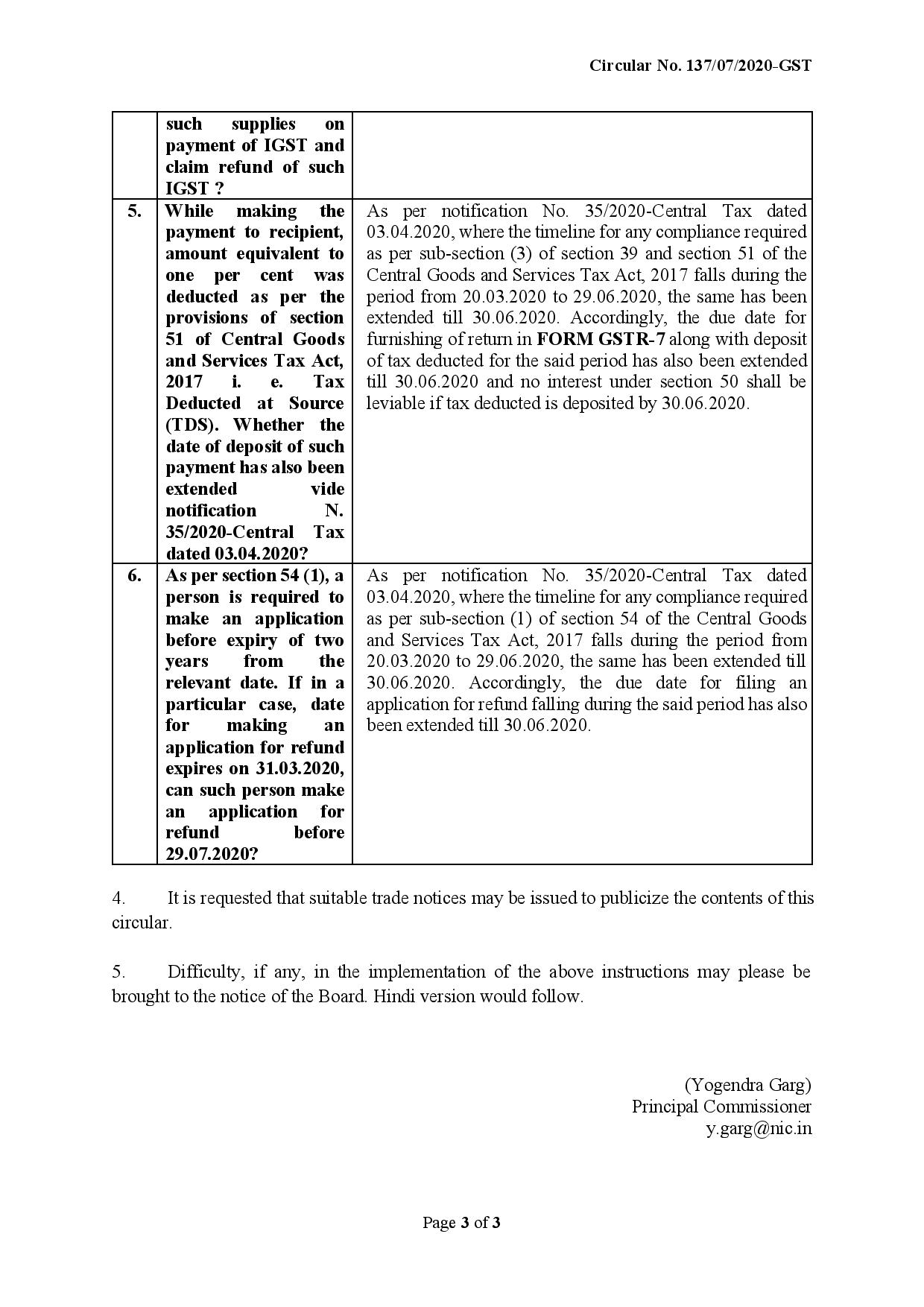

This latest move will help the industries cushion the shocks of the business loss faced by such industries as this move will help them improve their liquidity position in the market. The CBIC released a circular on April 13 clarifying the details of the move. The circular states – in case GST is paid by the supplier on advances received for a future event which got cancelled subsequently and for which invoice is issued before the supply of service, the supplier is required to issue a “credit note”.

According to the industry experts, this move has come to the rescue for companies that had especially suffered post furnishing full refunds to consumers because of cancellations, either from the company side or the consumer side, to prevent the spread of COVID-19. “In cases where there is no output liability against which a credit note can be adjusted, registered persons may proceed to file a claim under “Excess payment of tax, if any,” the circular also stated.

We, Wedding Affair magazine appreciate this step taken Govt. of India and have posted the copy of the order here for ready reference.